Content

An excellent nonparticipating FFI try a keen FFI aside from a great performing FFI, deemed-agreeable FFI, or exempt useful proprietor. Costs to those groups, yet not, must be claimed for the Form 1042-S if the percentage are subject to chapter step 3 withholding, even if zero income tax is withheld. If you make an excellent withholdable payment to a single of your brands from agencies discussed above, the newest payee is the individual to have which the brand new representative otherwise mediator accumulates the fresh payment. Entity A great are a corporate team arranged beneath the regulations out of nation X who’s a tax treaty in force which have the united states. Both nations Y and Z has a taxation pact in the push to your United states.

The brand new property owner need tend to strike a balance between promoting rents and minimizing vacancies and you can tenant turnover. Return is going to be expensive as the place need to be modified to meet the particular needs of various tenants—such, if the a cafe or restaurant is actually moving into a house previously filled because of the a pilates business. You’ll find four number one type of industrial assets leases, for each and every requiring other degrees of responsibility from the property manager as well as the tenant.

You are able to always become susceptible to the same funding progress income tax since the You.S. people when you are a resident alien. You happen to be at the mercy of the next taxation advice for those who fall under the newest nonresident alien class and also the just team you may have within the the brand new You.S. is assets for example stocks, common financing, and you can commodities which might be kept that have a great U.S. dollar-denominated brokerage firm or other agents. You will see that banks will generally financing you more income than you need to very borrow.

Indian Tax Residency Regulations: Very important Criteria to have Low-Residents

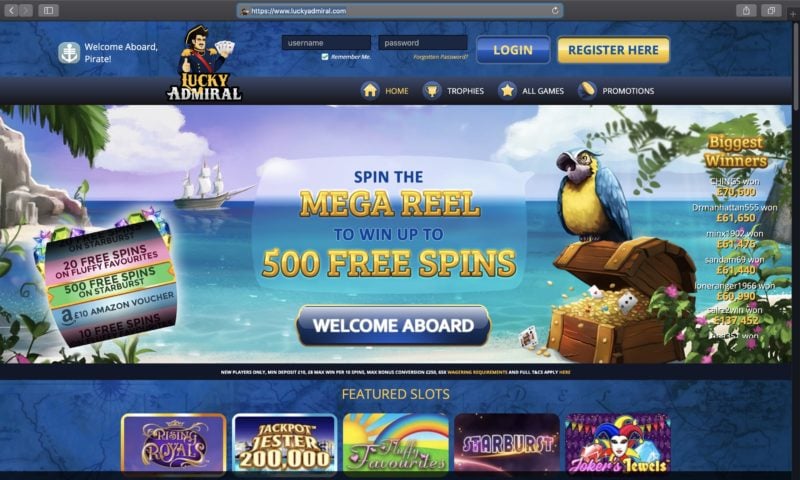

As a whole, PokerStars provides greater athlete swimming pools which allows they to offer of several various other competitions and you can online game. Total, PokerStars and 888poker one another provide many additional freerolls. It’s hard to express and therefore website actually offers the most, because the dates changes to your a keen monthly, per week as well as regular basis, however these a couple of workers features several. Legal internet poker sites have strong geolocation application that may enter as a result of almost all VPN communities, therefore preventing people away from outside the says from getting into real-money poker video game on the web. People are not required to live in a state in which on the web web based poker is courtroom to get involved in it. You merely become individually within the state from the once from gamble.

- In case your withholding broker understands otherwise features reasoning to find out that the newest quantity shown to your Mode W-cuatro may be not true, the new withholding broker need to refuse the shape W-4 and withhold during the suitable legal speed (14% or 31%).

- Yet not, such numbers commonly excused of withholding under section 4 when the interest is actually a good withholdable fee, until an exemption from section 4 withholding can be applied.

- The united states is actually an event to help you domicile-form of treaties which have Austria, Denmark, France, Germany, the netherlands, and the British.

- Instead, an excellent payee is generally eligible to pact professionals beneath the payer’s treaty if you have a provision in this treaty you to definitely can be applied especially in order to focus paid back by payer overseas firm.

Your wallet the difference between their expenses (along with rent) and the rental income obtained. Centered within the 1993, The brand new Motley Deceive is a financial functions organization dedicated to and then make the world wiser, happier, and you will richer. The brand new Motley Deceive reaches lots of people each month due to the premium investing alternatives, 100 percent free advice and market study on the Fool.com, private financing education, top-rated podcasts, and you may low-money The brand new Motley Deceive Base.

Whenever try a genuine Estate Statement needed?

An excellent 1031 change allows home people so you can defer money gains taxes by trading one to investment property for the next away from equivalent or greater worth, a taxation virtue unavailable in order to stock investors. To help you be considered, people need pick a replacement assets inside 45 times of promoting the unique assets and finish the pick inside 180 days, making it a powerful but date-painful and sensitive income tax method. Learning how to calculate your own Bang for your buck to your a home opportunities can be help you make choices regarding the assets orders, improvements, and conversion. Because the cost strategy also offers a simple treatment for scale output according to total investment, the newest away-of-pouch approach shows how leverage borrowed currency increases productivity.

Very first Freedom Lender ¥

While you are private lenders be versatile than simply old- https://vogueplay.com/uk/realistic-games/ fashioned lenders, they’ll nevertheless request the majority of the same files to evaluate your credit history, money, assets and cash disperse because of latest lender comments. They are studying this type of documents to possess average dumps on your membership and exactly how far cash is venturing out on the a month-to-month basis. If you are planning to offer accommodations property your’ve owned for under annually, attempt to stretch possession out to at the least 1 year in the event the you could, otherwise your own money will be taxed since the typical money.

It’s very a stand-out option for licensed buyers who would like to diversify the portfolios that have pre-vetted institutional-peak commercial real estate investment opportunities. REITs provide a low-prices and easy solution to invest in a house. Although not, they’re not the sole alternative to to buy an actual property. The actual estate funding companies here provide people with a great simple way to earn couch potato money due to domestic a house. The fresh Irs have a tendency to stamp copy B and send they to your people subject to withholding. See your face need to file a good U.S. taxation go back and mount the newest stamped Setting 8288-A toward discover borrowing for income tax withheld.

On the web platforms for example Airbnb and Vrbo have made that one popular. Subscribe BiggerPockets and also have entry to a house investing tips, market reputation, and you can exclusive email address blogs. An informed investment you possibly can make is certainly one that works for your funds and go out partnership while you are proving positive output. It’s crucial that you seek information on your industry’s requirements and the assets place.

Which certified statement represents the beginning of REITs in the mainland China. Because of the Oct 2015 there were 33 Southern African REITS and three non-Southern area African REITs on the Johannesburg Stock exchange, with respect to the SA REIT Organization,26 and that told you field capitalization is actually over R455 billion. This is an option difference in the economic come out on account of COVID-19 and you may what happened a decade prior to. It’s still unknown if the secluded work pattern you to began inside the pandemic can get a long-lasting effect on corporate office needs. One gifts provide in order to a girlfriend who’s a great You.S. resident during your existence are clear of government current income tax.

Which part shows you tips determine if a cost are subject to part step 3 withholding or is a great withholdable percentage. You may have cause to know that documentary facts are unreliable or completely wrong to determine a primary membership holder’s condition because the a foreign individual if any of your pursuing the pertain. You can also, although not, trust a questionnaire W-8 because the establishing an account holder’s allege of a lesser speed out of withholding below a pact or no of one’s after the implement. If you make a cost to a QI which is in addition to a QDD, the brand new QI must provide a great withholding statement designating the new makes up it acts as a good QDD whether or not they takes on primary withholding obligations for everybody money, unless it is becoming a QDD for all costs it receives. The fresh the quantity that you’ll want withholding rate pond guidance depends on the new withholding and you will reporting debt thought from the QI. The brand new allotment to provide a different TIN (as opposed to a good U.S. TIN) doesn’t connect with a fees to pay an individual for individual features.

Positive Financing and you will Taxation Professionals

REITs are bought and you may in love with significant exchanges, just like holds and you may change-traded fund (ETFs). Each other industrial and you will home-based a home render higher how to get on the a home and make use of leverage to construct your money. Renters is hang in there for decades and then make consistent monthly installments to pay for rent. Home also offers of numerous opportunities and you will incredible taxation advantages.

NerdWallet, Inc. does not give consultative otherwise brokerage functions, nor does it highly recommend otherwise indicates investors to purchase or sell kind of brings, ties and other investments. Residential a home is booming, so great sales will likely be difficult to find. Learning how to buy and flip properties is simpler today to the growth away from articles, from YouTube video in order to HGTV, outlining ideas on how to take action. Commercial a property, concurrently, continues to be pretty inaccessible to many people, in order to have a tendency to get your hands on sweet sale a lot more effortlessly.